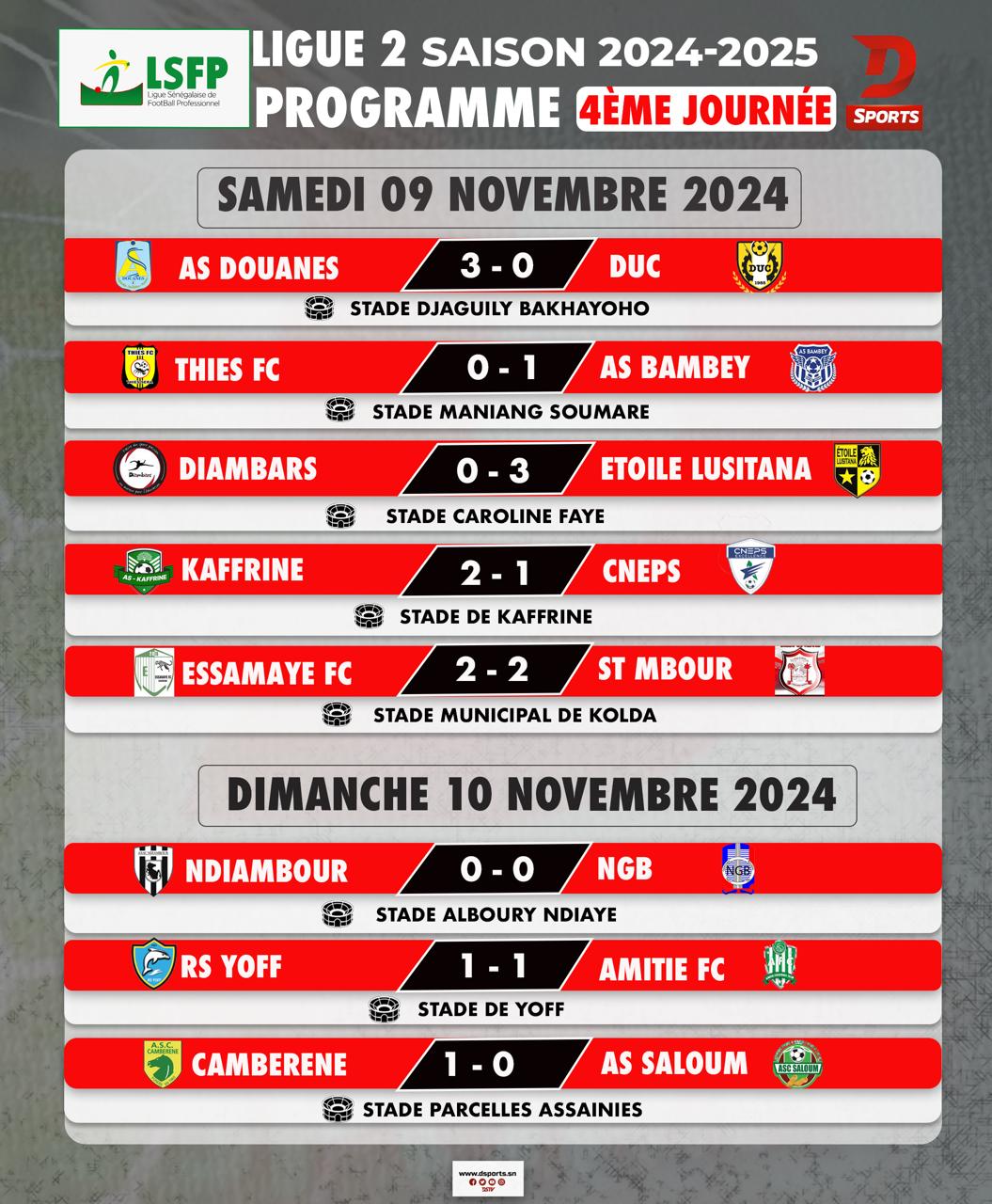

Après la journée prolifique du samedi, la Ligue 2 clôturait sa 4e journée ce dimanche 10 novembre. L’une des enseignements est la première victoire de la saison de l’AS Cambérène face à l’AS Saloum (1-0). Le seul but de la partie a été marqué en fin de partie par Sanou Thiaw Laye. Une 2e victoire de la saison qui hisse le promu sur le podium.

Cambérène (7 pts) accuse trois points de retard sur le leader AS Kaffrine (10 pts) et deux sur le dauphin Stade de Mbour (8 pts).

Après trois défaites de suite, Amitié FC (16e, 1 pt) a arrêté l’hémorragie ce dimanche en faisant match nul (1-1) contre la RS Yoff (14e, 2 pts). Cheikh Oumarou Diallo avait ouvert le score pour les Thiéssois avant l’égalisation yoffoise à la 89e minute par Do Laye Seck.

Impressionnant lors de la première journée avec une victoire contre Amitié FC (3-0), Niarry Tally n’arrive plus à gagner. Après le nul face à l’Etoile Lusitana (1-1) et celui contre CNEPS (0-0), NGB a encore été tenu en échec par Ndiambour (0-0).

Avec six points, les coéquipiers d’Abdoulaye Ba « Messi » occupe la 7e place au classement de Ligue 2. De son côté, Ndiambour reste 5e avec 7 points.

A.F

Home equity release may provide the financial support you’ve been needing. Learn how to use the equity tied up in your home without having to move.

Are you considering a secured loan to consolidate your debts? Find out more and check what solutions may be available to you.

If you’re a homeowner looking to borrow money, a secured loan could be a sensible option. Leverage better rates by using your home as collateral.

Unlock the value in your property with a reliable home equity loan — suitable for covering home improvements, large expenses, or debt consolidation.

You may be able to borrow more and enjoy better interest rates by taking out a loan secured on your property. Review current offers today.

You may be able to secure larger loans and enjoy lower monthly repayments by using your home’s equity. Find the best current offers today.

Uncertain whether a secured loan is right for you? Explore the benefits, such as more favourable terms and increased flexibility.

Unlock the equity in your property with a secure home equity loan — ideal for covering home improvements, major purchases, or debt consolidation.

Thinking about a secured loan to consolidate your financial obligations? Explore your choices and check what solutions may be available to you.

Thinking about a secured loan to manage your financial obligations? Explore your choices and check what solutions may be available to you.

Release the equity in your property with a reliable home equity loan — suitable for funding home improvements, large expenses, or refinancing.

If you’re a property owner looking to get a loan, a secured loan could be a wise option. Leverage better rates by using your home as collateral.

Considering releasing equity from your home? Compare top lenders and understand your rights and obligations before making a decision.

Thinking about releasing equity from your home? Compare top lenders and learn about your rights and obligations before making a decision.

Thinking about releasing equity from your home? Compare top lenders and learn about your financial responsibilities before making a decision.

Thinking about releasing equity from your home? Compare top lenders and understand your rights and obligations before making a decision.

Release the value in your property with a secure home equity loan — ideal for funding home improvements, large expenses, or debt consolidation.

You may be able to secure larger loans and enjoy lower monthly repayments by using your home’s equity. Review current offers today.

Explore how a secured loan can help you access the money you need without parting with your home. Review lenders and tailor a plan that fits your needs.

Unlock the equity in your property with a secure home equity loan — suitable for funding home improvements, major purchases, or refinancing.

Unlock the value in your property with a secure home equity loan — suitable for funding home improvements, large expenses, or debt consolidation.

If you’re a property owner looking to get a loan, a secured loan could be a sensible option. Access better rates by using your home as security.

Not sure if a secured loan is right for you? Understand the benefits, such as more favourable terms and increased flexibility.

Thinking about a secured loan to consolidate your financial obligations? Explore your choices and check what options may be available to you.

If you’re a property owner looking to get a loan, a secured loan could be a wise option. Access better rates by using your home as collateral.

Thinking about a loan against your home to manage your debts? Find out more and check what solutions may be available to you.

}